My Experience

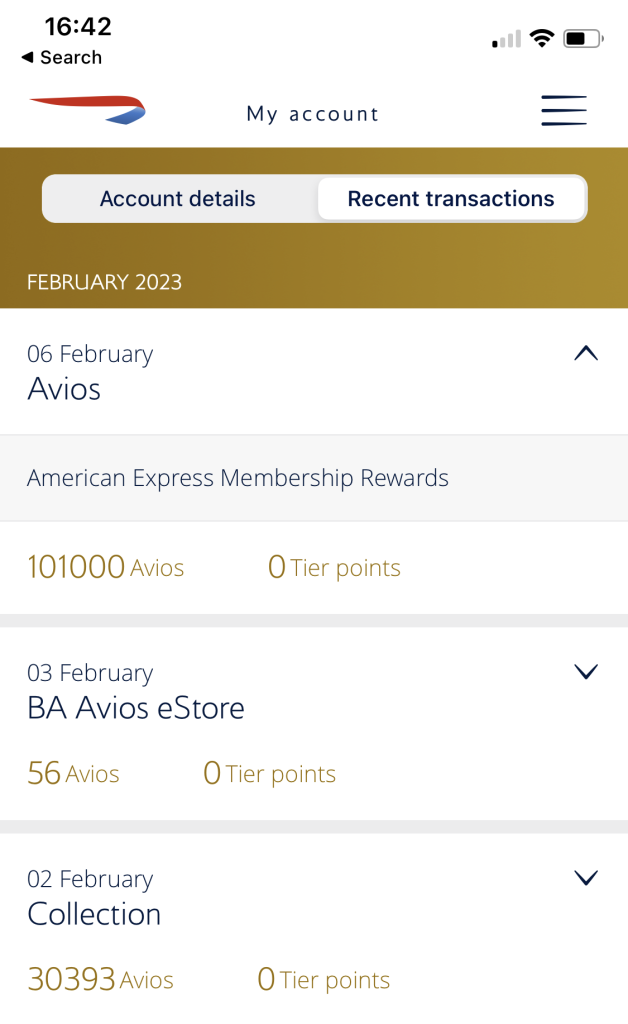

I chose the Platinum Card and never looked back. After having had the card for 8 months I gathered 101,000 Amex points (about £1,000 in value) without any extraordinary spending. To make the most of Amex points, transfer them to one of their airline partners. Most likely that would be British Airways but you can see the full list here. The transfer went through without any problem and the 101,000 Avios points appeared in my account a few days later.

A return flight with BA to a European destination costs around 20,000 points, which includes luggage and the ability to cancel the ticket for just £1 up to 24 hours before the flight. This is amazing value, especially when combined with the Platinum lounge access.

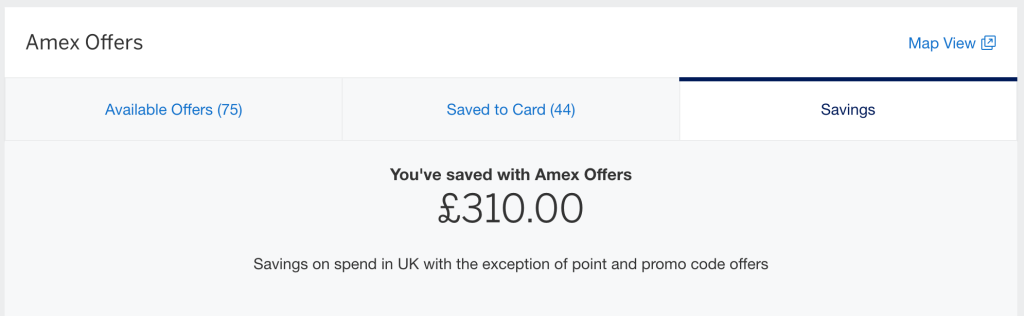

In addition, Amex runs various offers for eating out, traveling and shopping where I saved £310 on UK spend. This includes the UK dining credit, the Harvey Nichols credit explained below, plus additional credit statements. That being said, Amex is pretty bad at keeping track of all the savings. The actual savings, including foreign spend are around £600.

AmEx Platinum vs. Gold Recommendation

If you’re reading this, you most likely can afford either card. In this case, I recommend to take The Platinum Card and if you don’t feel like you’re getting enough benefits, downgrade to Gold after a year or cancel it altogether. This is mainly because the Platinum first year benefits are outsized so you can’t go wrong:

- Sign-up bonus (£500 value)

- 2x Dining statement credit (£600 value)

- 3x Harvey Nichols lifestyle credit (£150 value)

Let’s go through them one by one.

Sign-up Bonus

You can get 35,000-80,000 Membership Reward points as long as you meet the eligibility criteria by using this referral link (you may have to click “View all Cards with a Referral Offer” on the landing page). The actual amount depends on whether Amex is running a special offer at the time you sign up.

Global Dining

The Global Dining Statement Credit offers £150 for local (UK) dining and £150 for dining abroad per year. The thing to notice is that the benefit is per calendar year and it resets on January 1st. Therefore if you first membership year spans two calendar years, you’ll be able to claim this benefit twice, for a total of £600 in statement credits.

Harvey Nichols Lifestyle Credit

Similar to the above, the £50 HN credit resets on January 1st and July 1st, which means it’s possible to claim it three times during the first membership year, for a total of £150 in statement credits.

…and the rest

- 1 point for each 1£ spent (valued at roughly 1p each)

- AmEx offers. Typically 10-20% of the purchase price in statement credits at specific retailers

- Comprehensive travel insurance

- Free additional card. The primary card holder is financially responsible for both cards but this allows you to offer lounge access and travel insurance to another person. In addition, some AmEx offers can be used separately on each card

- Platinum service. I did have to call them on a couple of occasions and customer service was good.

- A few other perks which I never used

Amex Gold Benefits

The comparison would be incomplete without mentioning the unique Gold benefits. The Gold card has a fee of £160/year and the first year is free. The sign-up bonus varies between 20,000 and 30,000 MR points. Generally, referral links like the one below give a larger bonus.

There are two Amex Gold benefits which the Platinum does not include: two £5 Deliveroo statement credits per month and 2x points on money spent in a foreign currency and with airlines. The former gives you back £120/year and is good value if you already use Deliveroo consistently. The value of the airline spend bonus varies according to personal circumstances, while spending abroad on the Amex could be a good idea if you’re travelling for business and you get your expenses reimbursed. Otherwise the foreign exchange fees outweigh any bonus points.

Most Platinum travel benefits are either watered-down or not available on the Gold card. For example it offers only 4 airport lounge entries per year instead and doesn’t include Centurion lounge access.

Quick Rules

Are you wondering whether to get the AmEx Platinum or the Preferred Rewards Gold card? I was wondering the same thing 8 months ago. In hindsight, the answer boils down to how much you travel and what existing travel benefits you have. Here are some quick rules

- First things first. If the £575 fee will make you struggle financially, choose the Gold card (which has no fee in the first year)

- If you don’t already have lounge access through airline status and you travel more than a few times a year, The Platinum Card is the obvious choice. Doubly useful if, like me, you like to get to the airport well in advance of your flight

- If you have lounge access through your airline status, consider how often you fly with other airlines

- Peace of mind while traveling? The Platinum Card covers medical assistance and expenses plus car hire excess worldwide (amongst others), while the Gold card doesn’t. You don’t need to book your travel with the Platinum card for the medical and car rental insurances to be valid

Leave a Reply