In the UK, you can set yourself up to receive back roughly 1% of your every day purchases and 10% of hotel purchases at no extra cost. In addition, you can get various free perks for being a recurring customer (think late check-outs) and paid perks for premium subscription products. This article gives you a checklist to go through the get the most out of your spending.

The main goal here is to keep it simple. Think of this as your entry-level guidelines. Instead of exploring trade-offs and thoroughly breaking down details, we’ll choose a path that works best generally. As you get more familiar with hotel, credit cards, and airline programmes you can starting exploring outside these guidelines.

We’ll discuss free and paid products separately.

Free Programmes

- British Airways. Its member program—British Airways Executive Club (BAEC)—is free to join and its currency is Avios points. The are two big advantages of purchasing a ticket with Avios:

- You pay a fixed amount of Avios depending on the distance flown, flight class and peak/off-peak flight date. For example, a one-way ticket London-Paris is 9250 Avios, or the generally more advantageous 4750 Avios + £17.50, roughly equivalent to £65. This include hold luggage.

- You can cancel your ticket and get a refund on the Avios part up to 24 hours before the flight

- Marriott Bonvoy. You receive the equivalent of (roughly) 10% of your spend back in points and additional perks (think upgrades or free breakfast) depending on how many nights per year you’ve spend in Marriott hotels.

- If you often go to destinations where Marriott does not have a presence, Hotels.com (part of the Expedia group) has a richer portfolio and gives you the same 10% equivalent back as one free night every 10 paid nights. The downside is that the perks it offers to are minimal

- 0% foreign exchange fee card (most cards charge you an extra 3% abroad). These cards typically come without any perks. That being said, no credit card perk is valued at 3% or more of your purchase. I’ve been using the free Monzo card for many years. Besides 0% fees for payments abroad, it also gives you an allowance for free ATM withdrawals abroad. Halifax Clarity is one of the few credit cards with 0% foreign exchange fee.

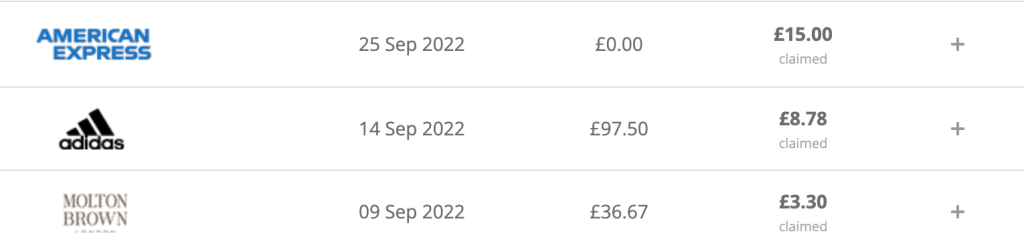

- Join a cashback site. It’s easy to do and you get 2-10% back on many day-to-day purchases. topcashback.co.uk or British Airways shopping are good options. The latter only pays back in Avios, while TopCashback has multiple option to withdraw your money, including bank transfer. See our full article about UK cashback sites for more information.

Paid Programmes

- American Express The Platinum Card. This card mainly improves the quality of international travel: lounge access, instant hotel chain and car rental status, worldwide travel insurance. You also get £300 to spend at a curated list of bars and restaurants. The comfort comes at a cost but it’s well worth it if you can afford it.

- [optional] A second rewards credit card. This is useful for two reasons

- American Express is not accepted everywhere

- You can get additional rewards if you meet a spend threshold. The Barclays Avios MasterCard (both free and paid version) is a good option and rewards you with a BA upgrade voucher if you spend £10,000 (£20,000 for the free version) in a membership year, in addition to 1.5 Avios (1 for the free version) per £1 spent.