I’ve had the Yonder Credit Card for a month and just made the first redemption for a Sunday roast at London’s Ham Yard bar and restaurant. It’s time for a review. I will focus on the card’s feature that I’ve found most useful and skip others like redemptions for retreats or Mastercard World Elite benefits.

Who’s Yonder For

The short answer: for people who eat out in London and a few other large UK cities: Manchester, Birmingham, Bristol and Bath. You can also get good value redemptions at some West End musicals and theatre, plus a garden variety of online lifestyle shops, ranging from food and drinks to flowers and clothing. Although you can also redeem points on air travel, the value that you get is lower. Yonder is still experimenting with their value proposition, for example air travel was added just a couple of weeks ago, so this list may change.

Yonder calls the places where they offer preferential redemption rates Experiences, and I’ll reuse the term below to refer to them. Some of the Experiences, and the restaurants in particular, change every month so you won’t run out of places to redeem your points.

What are Yonder Points

Yonder has its own rewards currency, the Yonder Point. 2 points are worth a little under 1p when used at good value redemptions. You generally earn 5 points for each £1 spent, but this can go up to 25 points per £1 at Experiences. Doing the math, this means just over 2% back on all spend, and around 11% back at Experiences. To put this into perspective, Amex Gold and Platinum offer (approximately) the equivalent of 1% back in MR points, while the Amex BA Premium Plus offers 1.5% back in Avios.

You cannot transfer Yonder Points into any other loyalty program but you can send points to friends who also have the card.

How Do You Earn Points?

You earn points on any spend on your card. However, there are two things that differentiate Yonder from other reward cards, like American Express Gold/Platinum. First, there’s no foreign exchange fee, so you earn points abroad the same way you do at home. Before Yonder I was using Monzo and Halifax Clarity when traveling to avoid the 3% currency exchange fee all my other points-earning cards have. Second, Yonder chooses each month a few Experiences, most of them restaurants, where you earn 5x the usual amount of points, that is 25 points per £1.

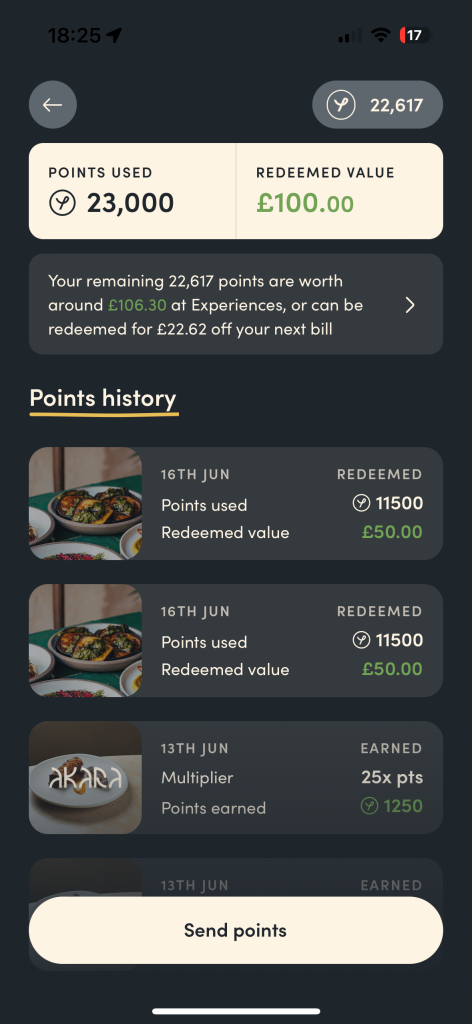

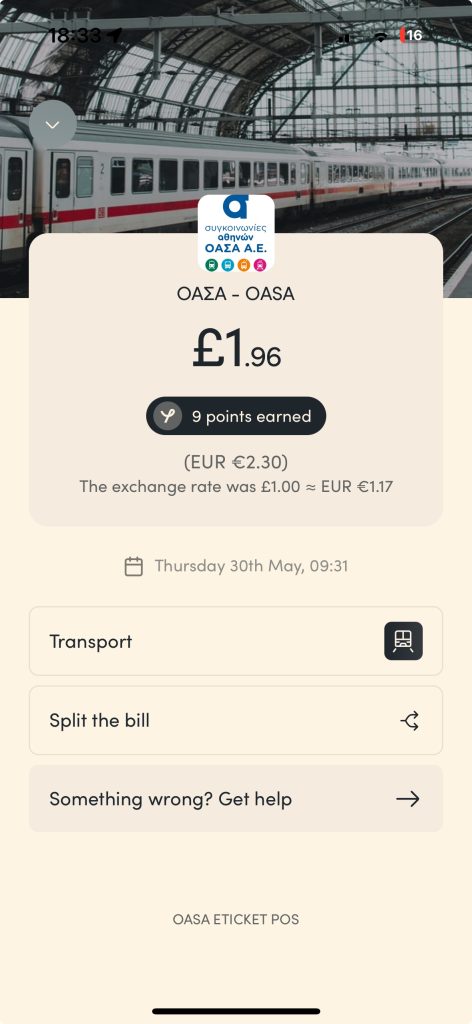

The first app screenshot on the right shows the points overview section. So far I’ve used 23,000 points to cover £100 off of restaurant bills. Further down, it shows the most recently earned points at one of this month’s experiences: 1250 points for a £50 bill. The second screenshot shows a single “regular” expense (a train ticket in Athens) which earned points at the 5 points/£1 rate and used the Mastercard exchange rate with no additional fees.

How Do You Redeem Points?

You can redeem points at Experiences or towards your next bill. The rate for the latter is poor so I won’t discuss it. To redeem at an Experience, first pay the exact same way you would with any other card. Then go to app, where Yonder automatically recognises that you’ve paid at an Experiences and lets your either redeem points and pay less or pay the full amount and earn at the preferential rate.

Pro Tip: ask the waiter to split the bill, and paying twice with the same Yonder card, if you want to fully maximize your earnings. That’s because you can only redeem points in fixed amounts, which depend on Experience. If the amount you redeem is lower than the bill, the rest of the bill, paid with £££ will only earn 5 points/£1. If the amount you redeem is higher than the bill you’re giving away points. So depending on how much you care about squeezing the most points out of your spend, you can ask to pay the bill in two transactions, one that matches exactly one of the fixed amounts that can be redeemed at that Experience and the other with the rest. You then choose in the app to redeem points against the first transaction and earn points for the second.

For example, say you go to The Pelican, where the amounts you can redeem against are £35, £70 or £140. The bill comes at an even £100. You can pay it into a single transaction and redeem 17,500 points against £70 and earn 30×5=150 points on the remaining £30 that you pay with cash. Or you split the bill into two transaction, one for £70, the other for £30. You redeem the same 17,500 points against the first one to fully cover it and earn 30×25=750 points on the second one.

Costs and Benefits

The card comes in two flavours: a paid version, which I described above, and a free version, which earns 5x less points. The paid version costs £15/month or £160/year if paid in advance, but the first 3 months are free if you use the link below. The paid version also includes travel insurance, a metal card and 10,000 points sign-up bonus.

Valuing the points at 0.5p, the equivalent of the annual fee is 32,000 points. As you can see in the screenshot above, I’ve made more than that in the first month by spending £2,500, excluding the sign-up bonus. For me, the card seems like a clear win and I’ll keep it for a full year after the first 3 free months.

Compared with Amex

There are some similarities between Yonder and Amex Gold. Both are priced similarly, earn rewards and include travel insurance. The details differ a lot though. To reiterate:

- There’s no FX fee on Yonder, there’s 3% on Amex

- Yonder is a MasterCard. It’s accepted in more places than Amex

- Yonder focuses on dining rewards in a few UK cities. Amex focuses on travel rewards

- Amex includes Amex Offers and various lifestyle perks, including priority booking at the various events that it sponsors. Yonder gives access to MasterCard World Elite’s priceless.com offers.

All in all, whether Yonder is right for you depends on your circumstances. For me it makes sense it addition to Amex, although I am pondering whether to take a break from Amex for two years so I can get a new sign-up bonus 🙂

Leave a Reply